Wall Street Wakes Up: "Pfizer: Don't Bank On mRNA Vaccines". Yes. We Told You That Many Moons Ago. Many Times.

Cold shower on mRNA Vaccines I could have written myself. Yes, it was published on April 1... but it's no joke.

I’m not a star or savvy investor, but to keep tabs on trends in the biomedical industry, I subscribe to “SeekingAlpha”.

Warning, grab your jaw, what you’re about to read could have been written by Peter McCullough, Jessie Rose, Steve Kirsch, myself or many others who have sounded the warning bells on mRNA vaccines. Wall Street has spoken: We Were Right.

Source: SeekingAlpha

Pfizer: Don't Bank On mRNA Vaccines

Apr. 01, 2023 12:55 AM ETPfizer Inc. (PFE)138 Comments12 Likes

1.45K Followers

Follow

Summary

A huge increase in cost may reduce demand.

Contradictory evidence on efficacy and safety may be a concern moving forward.

Eminent virologists cast doubt on the long-term viability of mRNA vaccines.

Preamble

In my previous article, I gave a balanced view of mRNA vaccines, however, on this occasion, I focus on a report that was made available in Australia as a result of a "Freedom of Information Act" in December 2022. This report assesses Pfizer's (NYSE:PFE) pre-clinical data, and was available to regulatory authorities in January 2021, prior to the vaccine rollout. The ramifications of this data are only now becoming appreciated by the general public, since it contradicts data provided by the large scale human trials. In addition, eminent virologists have concluded that such technology will never be wholly effective against infections by agents such as COVID.

During the last quarterly conference call, Pfizer forecast continuing high earnings from its mRNA vaccine segment. As there is this new data in the public domain together with large price hikes planned, the ambitious revenue targets for the vaccine would appear to be unrealistic.

Pfizer

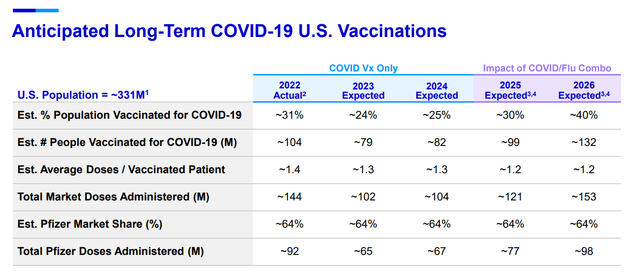

Whilst it is true that Pfizer believes that revenues from sales of new product launches, recently acquired medicines, and current products will increase income by between 7% and 9% in 2023, as you can see from the graphic below, the company also expects quite a sizeable contribution from its COVID vaccine.

In fact, according to the last quarterly earnings call, Dave Denton, CFO, stated that; "In 2023, we expect about 24% of the population, or 79 million people, to receive vaccine doses for COVID during this year." This expectation equates to approximately 102 million total vaccine doses for 2023.

These days fewer and fewer people are getting their boosters, even though they are free. Therefore, one has to wonder what a huge price increase will do for demand, especially if the recipient has to pay. During the quarterly call, the company disclosed that it is contemplating a price of between $110 and $130 per COVID dose going forward. It would appear that the new price will be implemented this year, once all the free doses are exhausted. It seems to me that investors may be overestimating the durability of Pfizer's Covid-19 vaccine revenue if prices rise to such a level. Although, Angela Lukin, Pfizer's U.S. president of global primary care, has a different view. She says; "Based on our current understanding, when we enter a traditional commercial model, anyone with commercial or government insurance who is eligible to be vaccinated should be able to access the vaccine without any out-of-pocket payments." Whilst this may be true for the US, in other countries, individuals may have to pay themselves.

The last quarter's report also disclosed the tantalizing prospect that there will be the introduction of a COVID/flu combo which could boost revenues significantly. In addition, there may well be continued demand for Paxlovid, the oral treatment for COVID.

Contradictory evidence

New medicines are initially tested on living organisms that are genetically close to humans; typically, primates. As you may imagine, these lab tests are done to determine a level of efficacy and safety for the new medicine. Results of these tests are then sent to the U.S. Food and Drug Administration (FDA), and the FDA determines if the treatment is safe enough to be studied in human volunteers. Then, once the medication is determined to have value and is free of safety concerns, human trials are conducted.

Whilst the results of the large scale human trials have been widely published, the non-human test data, sponsored by Pfizer, has only recently become available.

The report, which was released by the Australian government, is based on Pfizer's own preclinical research. This is confirmed in the summary of the report, which states;

"The sponsor has generally conducted adequate studies on pharmacology and toxicity (GLP compliant repeat dose and developmental and reproductive toxicity studies) with BNT162b2 (V9). Limited pharmacokinetic studies were conducted with the LNP formulation and two novel lipid excipients (ALC-0159 and ALC-0315)".

If you plough through the document you will find that it highlights some exceptionally concerning information that was provided by Pfizer. For instance, on page 44 we can read that the lipid capsules that carry the components for the manufacture of the "spike" protein are widely distributed after injection. What this means is that these capsules can deliver the mRNA vaccine to virtually any cell in the body. Once a cell in the body begins manufacture of the spike protein, inflammation occurs, that is to say, the body releases chemicals that trigger an immune response. In medical terms, such an event is given the suffix "itis." For example, the heart has a protective membrane around it called the pericardium. In pericarditis, the pericardium gets inflamed and is often caused by a viral infection. Now, if you take a look at Pfizer's data, you will find a considerable number of such "itis'."

There is also conflicting information concerning efficacy. On page 4 we can read the following; "Almost similar microscopic lung inflammation was observed in both challenged control and immunized animals after the peak of infection (Days 7/8)." This data infers that there was almost zero protection against SARS-CoV-2 infection provided by Pfizer's vaccine as compared to unvaccinated primates.

If the above were not bad enough, on page 9 we can read that; "one study found that among people who had recovered from COVID-19, 100% had S protein-specific CD4+ T cells in the circulation and 70% had S protein-specific CD8+ T cells in the circulation." In short, in previously infected individuals, there was an immune response to COVID in 100% of this cohort.

The above is not the only troubling data in the report, but the material above gives a flavour of the content therein.

If indeed the above were true, one would reasonably expect a large number of vaccinated individuals to become sick with some "itis" or other. And in fact, as described by Pfizer's own data, there is an extravagant collection of such issues. In my article, "HCA Healthcare: An Investment For Interesting Times," I speculate the interesting phenomenon of increasing poor health, by strange coincidence, from the commencement of mass vaccination for COVID. May I emphasize that there is, as far as I'm aware, no research that links the two at this time.

I might also point out that, in my opinion, this increase in poor health may benefit Pfizer's other range of products in some areas of disease, the silver lining in the cloud for investors.

The future of the mRNA vaccine platform

It has long been appreciated that the SARS-CoV-2 virus has mutated countless times, and if you check the latest data, you will find many variants have been identified. Furthermore, a recent article published in The Lancet suggests that some of the variants are active for only a few months. The virologists that wrote this article go further to opine that; "In terms of sequence and epitope expression, the XBB omicron subvariant is now as distant from wild-type SARS-CoV-2 as SARS-CoV-2 is from SARS-CoV, such that XBB should probably be called SARS-CoV-3." Given that the virus changes so quickly, the authors concluded that the immunity conferred by the mRNA vaccine is "poorly durable."

To sum up

It is entirely possible that Pfizer's targets for mRNA vaccine uptake will fail to materialize as the general populace consider the consequences to receiving an inoculation. However, there is always the possibility that governments may make a vaccination mandatory, despite the potential risks. Also, if one accepts Pfizer's assertion that sales of non-COVID related products will increase, by over 7%, PFE stock would be a hold rather than a sell, especially given the increase in illnesses.

Wow! Never thought I’d see the day. Have we reached the tipping point?

Wall Street must finally be listening to Ed Dowd.