NY Jury Finds Former Senior Statistical Program Lead at Pfizer GUILTY of Insider Trading and Conspiracy to Commit Insider Trading

PUMP AND DUMP SCHEMES HARM CHILDREN AND OTHER LIVING THINGS. Now, SEC, let's have a closer look at those early press releases on mRNA jabs and which CEOs sold stock, what they knew, and when.

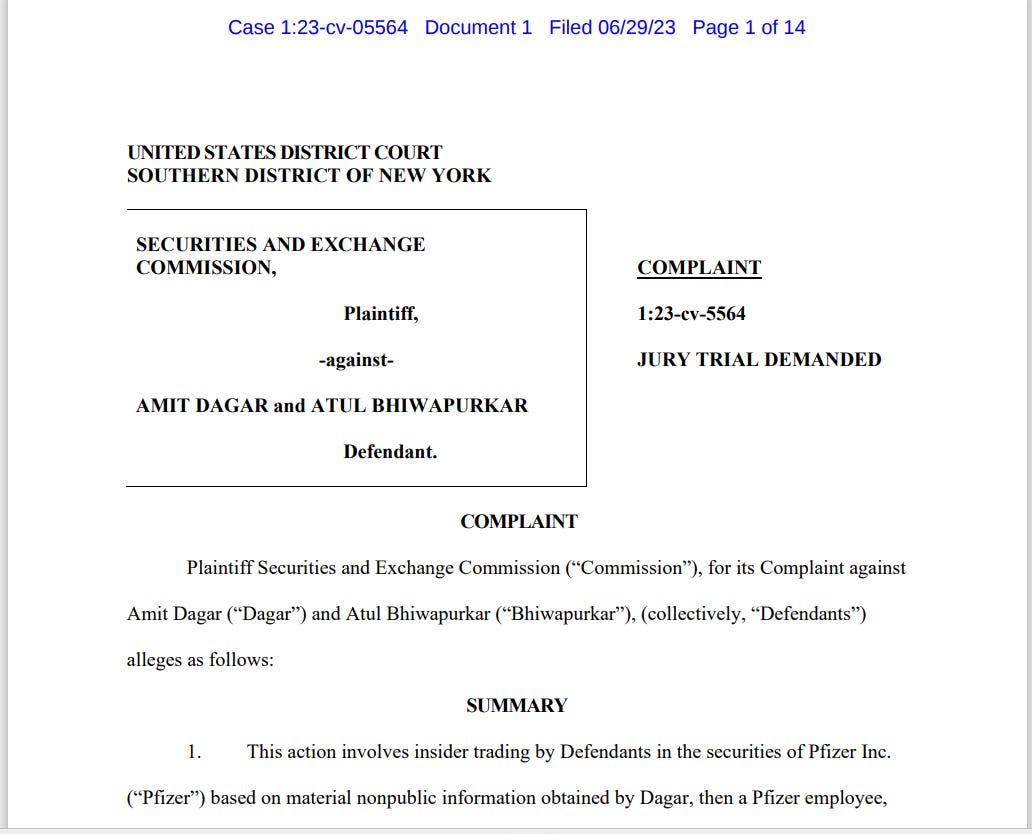

After a brief two-week trial, the U.S. Attorney for the Southern District of New York announced that a federal jury convicted Amit Dagar, a former employee at Pfizer, of insider trading and conspiring to commit insider training in November 2021 based on clinical trial results for the company’s COVID-19 pill Paxlovid.

Dagar was part of a team responsible for statistical programming and analysis at Pfizer. This involved developing and implementing statistical software solutions and algorithms to analyze clinical trial data. He played a crucial role in compiling and organizing data for Pfizer's clinical trials. This task is fundamental in ensuring that the data are accurate, reliable, and ready for analysis.

As a senior lead, Dagar's role was integral to the success of clinical trials at Pfizer. His work would have directly contributed to the processing and interpretation of clinical trial data, which is essential for determining the efficacy and safety of new drugs. In his senior position, he would have also been involved in collaborating with other departments and leading teams within the statistical programming sector, ensuring that projects were completed efficiently and effectively.

Part of his responsibility would also include ensuring that all statistical programming activities comply with regulatory standards and ethical guidelines.

According to Yahoo! Finance, “Dagar was a senior statistical program lead for the Paxlovid drug trial, according to the U.S. Securities and Exchange Commission's parallel civil case against Dagar and his friend Atul Bhiwapurkar.”

After a two-week trial before U.S. District Judge Andrew Carter, the jury returned a guilty verdict on Amit Dagar, a former senior statistical program lead at Pfizer, for insider trading and conspiracy to commit insider trading.

The charges carry a maximum sentence of 20 years and five years in prison, respectively.

According to court filings, Dagar, 44, who was the senior member of the team involved in planning and analyzing the data from all of Pfizer clinical trials, learned on Nov. 4 that Paxlovid had generated positive trial results. While the data remained confidential, Dagar purchased out-of-the-money Pfizer call options later that day. He also tipped off a friend, Atul Bhiwapurkar, who was arrested in June 2023 in connection with the case.

Following Pfizer’s publication of the trial results on Nov. 5, share prices surged more than 10%. According to court documents, Dagar then also illegally sold his call options, taking over $214K in profits in a single day.

“Dagar, who purchased $8,380 in Pfizer call options, generated a one-day profit of approximately $214,395, the SEC said. That represents an investment return of approximately 2,458%, according to the agency. Bhiwapurkar, who purchased $7,400 in call options, generated a one-day profit of approximately $60,300, the SEC said.” -CNBC

His friend Bhiwapurker, who also then tipped off a third person who also netted ill-gotten gains, pleaded guilty to the charges before U.S. Magistrate Judge James Cott in October.

“Combatting the corruption of our financial markets continues to be a top priority of this Office. Would-be insider traders tempted by the prospect of easy money should know that the Southern District of New York is watching, we’ll catch you, and we’ll make sure you pay the price for violating the law.” U.S. Attorney Damian Williams said in a statement.

I would like to remind Popular Rationalism readers the initial press releases on COVID-19 mRNA jabs failed to comply with SEC regulations and did not contain the phrase “FORWARD-LOOKING STATEMENT”.

I would also like to remind readers of this Nov 11, 2020 article by Fierce Pharma, which reads:

“Bourla was making some noise at the time about the possibility of getting a vaccine approved before the election, but he later tempered his predictions. And the company did not solidify its status as the front-runner in the race to end the COVID-19 pandemic with a vaccine until it released the efficacy data in people this week.”

The title of the article reads "Lucky Pfizer CEO Bourla cashes out $5.6M worth of stock—perfectly legally—as COVID-19 vaccine data lift market"

RELATED RATIONALISM

Yeah they take down a small-fry scientist. What about the Congress-critters? Bourla? Two tiers of justice. Disgusting.

Funny how these government agencies only go after the small fish. Nancy Pelosi et al have been making themselves millionaires off insider information so much over their tenure that it seems that’s their primary career over and above what’s on paper.